The User Interfaces (UI) and the User Experiences of AI-based stock trading platforms are essential for their usability, efficiency as well as overall satisfaction and their overall performance. A poorly designed interface can hinder decision-making, even if the core AI models are reliable. Here are 10 tips to assess the UI/UX on these platforms.

1. Easy of use and intuitiveness are important factors to consider.

Navigation: The platform should be easy to use. It should have easy-to-use buttons, menus and workflows.

Learning curve: Assess how quickly and efficiently an unexperienced user is able to comprehend and utilize your platform with no extensive instruction.

Consistency: Look for designs that are consistent (e.g. buttons, color schemes and so on.) across the whole platform.

2. Make sure you check for customizability.

Dashboard customization: See whether dashboards can be modified to display data, charts and other metrics that are relevant to the user.

Layout flexibility: Make sure that your platform is able to allow users change the size or layout of widgets as well as charts.

Make sure to check the platform's dark and light choices or preferences for visuals.

3. Visualize the data with the Assess Tool

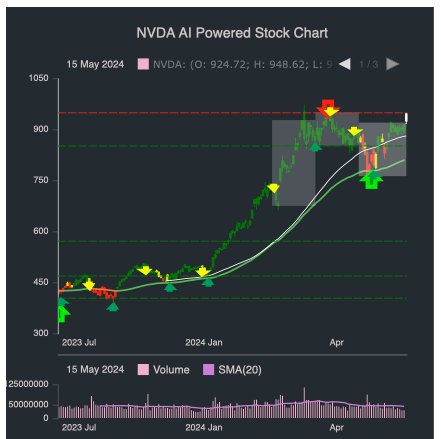

Chart quality: Make sure the site offers interactive charts of high quality (e.g. candlestick charts lines charts) that include zoom and pan functions.

Visual clarity: Make sure that the data is presented clearly and is labeled appropriately as well as legends and tooltips.

Real-time Updates: Make sure to check whether your charts reflect the most current market information.

4. Test for Speed and Reactivity

Speed of loading: Ensure that your platform loads fast regardless of handling huge data sets or complicated calculations.

Performance in real-time: Verify that the platform can handle data feeds immediately without any lag or delay.

Cross-device compatibility: Make sure whether your device works across all devices (desktops and mobiles, as well as tablets).

5. Assess Accessibility

Mobile app availability: Check if the platform has a mobile app that is fully capability to trade while on the move.

Keyboard Shortcuts: Check that your system supports keyboard shortcuts.

Accessibility features. Check the platform's conformity to accessibility standards.

6. You can sort and search your results.

Search function: Make sure that your platform permits you to search quickly for indexes, stocks and other investments.

Advanced filters: Check whether users are able to apply filters (e.g. by sector, market cap and performance indicators) to narrow results.

Saved searches: See whether you can save searches and filters that you frequently use.

7. Check for Alerts, Notifications and Other Information

Individually customizable alerts: Users can make alerts that are based on specific conditions, such as price thresholds and spikes in volume and news developments.

Delivery of notifications: See whether alerts are delivered through different channels (e.g. email, SMS and app notifications).

Timeliness - Make sure whether alerts are sent out quickly and precisely.

8. Evaluation of Integration with Other Tools

Broker integration: Ensure that the platform is fully integrated to your broker account in order to facilitate trade execution.

API access Find out whether APIs are accessible to advanced users who want to create custom workflows or tools.

Third-party integrations: Determine whether the platform allows integrations with other applications (e.g., Excel, Google Sheets and trading bots).

9. Evaluate Help and Support Features

Onboarding Tutorials: Check whether your platform has tutorials or guides for novice users.

Help center: Ensure the platform is well-equipped with a support center or knowledge base.

Customer support - Check whether the platform has a an efficient support (e.g. email or live chat).

10. Test Overall User Satisfaction

User feedback: Research reviews and testimonials to gauge overall user satisfaction with the platform's UI/UX.

Trial period: Use the demo or trial version for free to try the platform out for yourself and test its effectiveness.

Verify that the error handling is correct.

Bonus Tips

Aesthetics: While functionality is key visual appeal, an appealing design can enhance the overall user experience.

Performance under stress: Test your platform in volatile markets to verify that it's responsive and stable.

Check for active forums and communities that are active. Users can post their tips and feedback on these forums and communities.

The following tips can assist you in evaluating the user interface and UX of the AI trading platforms that predict and analyze stocks, making sure they are user friendly efficient and in tune with your needs in trading. A well-designed UI/UX is an extremely effective tool that can aid you in making better decisions and trades. See the top I thought about this on ai trade for blog examples including using ai to trade stocks, trading with ai, ai stock picker, ai for trading, ai stock market, ai stock market, best ai for trading, ai investment app, ai for stock predictions, best ai stock trading bot free and more.

Top 10 Tips To Assess The Transparency Of Ai Stock Trading Platforms

Transparency can be a key factor when making a decision about AI trading and stock prediction platforms. Transparency is essential since it lets users be confident in the platform, comprehend the reasoning behind its decisions and confirm the accuracy. Here are the top ten suggestions to assess transparency in these platforms.

1. A Clear Explanation of AI Models

Tip Check to see if the platform has an explicit description of the AI algorithms, models and platforms that are used.

The reason: By knowing the technology, people can assess its reliability and limits.

2. Data sources that are disclosed

Tips: Find out whether the platform makes public what data sources are used (e.g. historical stocks, news, and social media).

The platform uses reliable and complete data if you know the sources.

3. Performance Metrics & Backtesting Results

Tip: Be sure to look for transparent reporting on performance metrics such as accuracy rates and ROI, in addition to backtesting results.

This will give users the ability to compare past performance against the latest platform.

4. Real-Time Updates and Notifications

Tips. Check if the platform is able to provide real-time information and alerts regarding trades or changes in the system, for example trading predictions.

The reason: Real-time transparency makes sure users are always informed about crucial actions.

5. Open Communication about Limitations

Tip Check that the platform is clear about its risks and limitations in relation to forecasts and trading strategies.

Why: Acknowledging your limitations will build trust with users and help them make decisions based on facts.

6. Raw Data to Users

Tips: Ensure that users are able to access the raw data used in AI models or intermediate results.

How do they do it? Users are able to do their own analysis and verify their predictions using the raw data.

7. Transparency of charges and fees

TIP: Ensure that the platform clearly outlines the costs for subscriptions, fees, and potential hidden charges.

Transparency in pricing is a great thing. It reduces the risk of unexpected expenses and boosts confidence.

8. Regular reports and audits

TIP: Find out if the platform is regularly updated with reports or is subject to audits by a third party to validate its performance and operations.

Why: Independent verification adds credibility and assures accountability.

9. Explainability of predictions

Tip: Check if the platform provides information on how recommendations or predictions (e.g. the importance of features or decision tree) are generated.

Why? Explainability lets users to gain insight into the rationale of AI-driven decisions.

10. Customer feedback and support channels

TIP: Determine if there are open channels that allow users to give feedback and get support. Also, check whether it is clear in the way it responds to issues that users have raised.

Why: Responsiveness in communication is a mark of dedication to transparency.

Bonus Tips - Regulatory Compliance

Check that the platform is in compliance with financial regulations relevant to the business and inform customers about its compliance status. This adds another layer of transparency and trustworthiness.

By carefully evaluating these aspects it is possible to determine if an AI-based stock prediction and trading system is operating in a transparent manner. This allows you to make informed decisions and build confidence in the capabilities of AI. Take a look at the recommended free ai tool for stock market india hints for website examples including chart ai trading, best ai stocks, free ai stock picker, ai in stock market, invest ai, stock trading ai, ai stock investing, chart analysis ai, best ai trading platform, stocks ai and more.